Вавада казино

Дата проверки зеркала:

Vavada казино один из престижных игровых залов в СНГ и имеет мировую популярность. Оно завоевало высокую лояльность игроков благодаря своей официальной лицензии, которая гарантирует честность и надежность игрового процесса без скрытых подводных камней.

Несмотря на легальность работы и превосходную репутацию, официальный сайт Vavada Casino периодически подвергается блокировкам со стороны Роскомнадзора. Контролирующий орган России ограничивает доступ к игровым заведениям из-за неоднозначной ситуации с азартными играми в стране. Однако, разработчики предлагают эффективное решение в виде рабочего зеркала, которое почти неотличимо от оригинального сайта благодаря точному отражению интерфейса и функциональности.

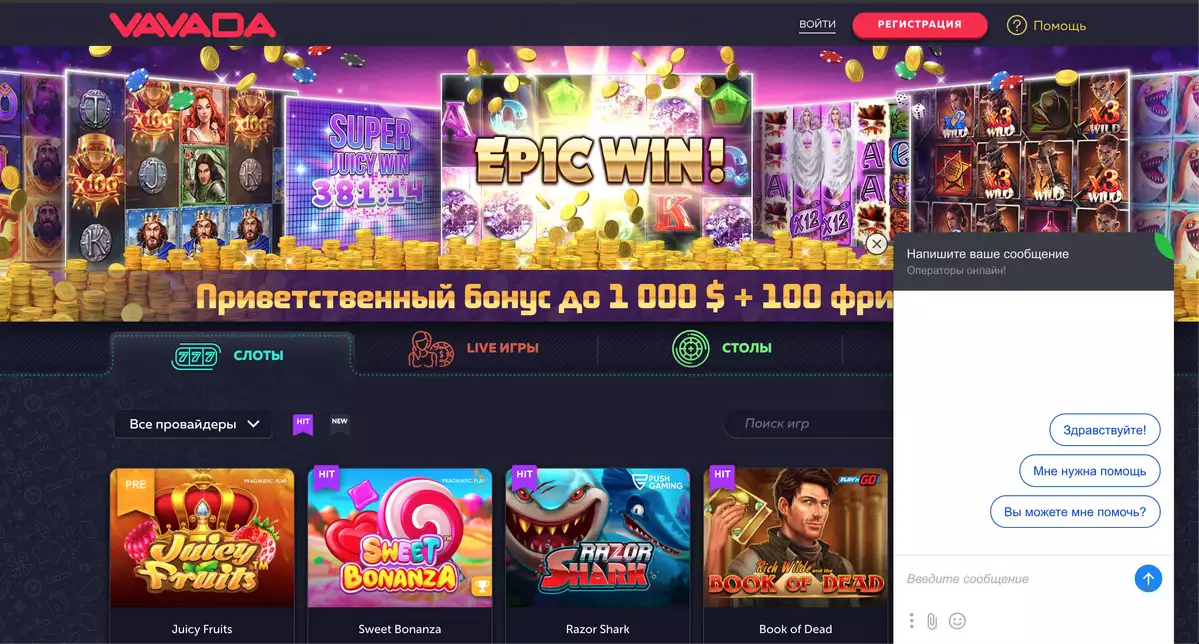

При входе на официальное рабочее зеркало Vavada Казино, клиент обнаружит знакомые кнопки навигации. В верхней части страницы находится личный кабинет, где можно дополнить свою анкету, создать новый кошелек, внести депозит или перевести средства другу, а также просмотреть уровень в программе лояльности и накопленные бонусы.

К сожалению, российские контролирующие органы неодобрительно относятся к онлайн-казино, и поэтому официальный сайт Vavada Casino регулярно блокируется Роскомнадзором как нарушающий законодательство. В таких случаях невозможен вход в аккаунт и продолжение игры. Однако, чтобы решить эту проблему, администрация казино периодически создает рабочее зеркало с измененным адресом для перехода. Внешне оно выглядит так же, как и оригинальный сайт, и сохраняет все особенности главного экрана, удобную навигацию и историю действий в профиле игрока.

Vavada зеркало доступно всегда, независимо от оригинального домена. Переход на него осуществляется по ссылке, и игрок сразу попадает на нужную страницу. Для авторизации достаточно ввести логин и пароль или можно зарегистрироваться на зеркале Vavada.

Личный кабинет с профилем, кошельком, статусом и бонусами полностью отображается, и есть возможность настроить свою учетную запись и обратиться в службу поддержки. Зеркало также хорошо функционирует на мобильных устройствах. Для входа достаточно перейти по ссылке с мобильного телефона или планшета и выполнить стандартную процедуру авторизации.

Если у вас скачано приложение Вавада, то использование зеркала не требуется, так как алгоритмы автоматически подбирают рабочий домен без вашего участия, что позволяет обойти блокировку незаметно.

На странице также располагается динамичный баннер, который приглашает принять участие в турнирах и розыгрышах крупных призов, а также получить приветственный бонус.

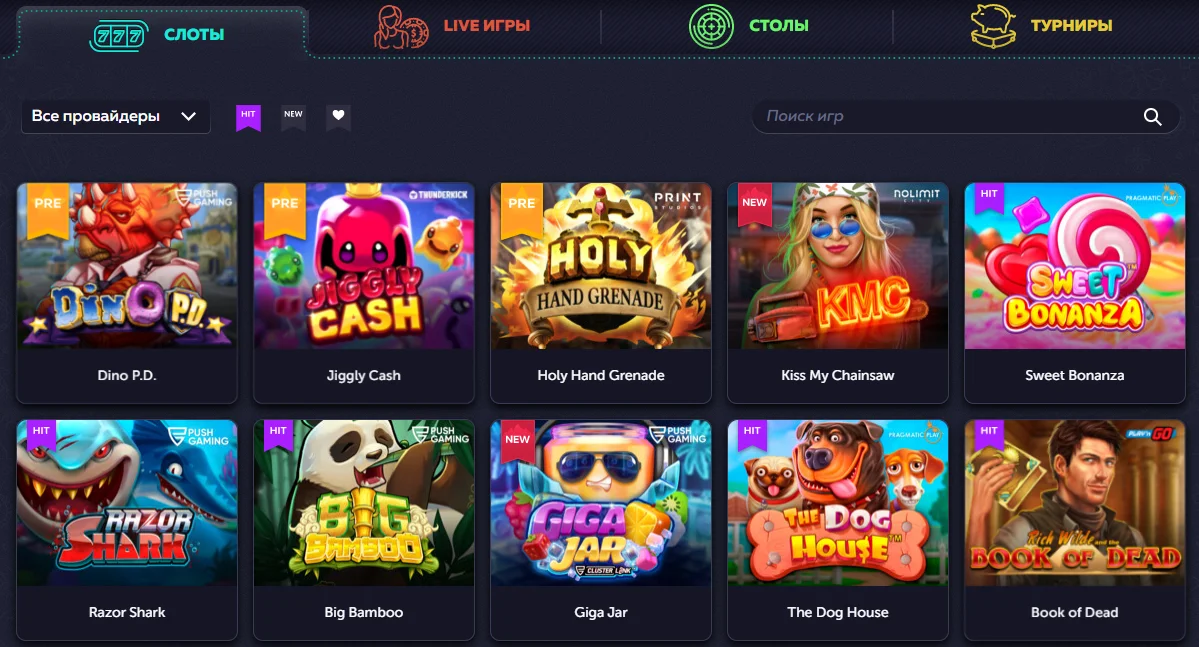

Далее начинается знакомство игрока с игровой библиотекой. Здесь можно выбрать интересующую категорию, такую как Слоты, Столы, Live Casino или Турниры, либо просмотреть список популярных развлечений. В данный момент в топе находятся такие слоты, как Sweet Bonanza, Big Bamboo, The Dog House, Fruit Cocktail и Gates of Olympus.

Vavada официальный сайт сотрудничает с ведущими разработчиками программного обеспечения, включая Amatic, BetSoft, Betgames, Microgaming, Blueprint, Slotmill, Red Tiger и Pragmatic Play. Полный список партнеров представлен в футере страницы. Там же можно узнать информацию о способах платежей, подписаться на социальные сети казино, ознакомиться с политикой сообщества и правилами ответственной игры.

| 🕹️ Игровая платформа | Вавада |

| 🎯Дата открытия | 13.10.2017 |

| 🚩Лицензия | КОльга С.сао (№8048/JAZ) |

| 🎰 Топовые провайдеры | NetEnt, Igrosoft, Novomatic, Betsoft, EGT, Evolution Gaming, Thunderkick, Microgaming, Quickspin |

| 🃏Тип казино | Браузерная, мобильная, live-версии |

| 🍋Операционная система | Android, iOS, Windows |

| 💎Приветственные бонусы | 100 фриспинов + 100% к первому депозиту |

| ⚡Способы регистрации | Через email, телефон, соц. сети |

| 💲Игровые валюты | Рубли, евро, доллары, гривны |

| 💱Минимальная сумма депозита | 50 рублей |

| 💹Минимальная сумма выплаты | 1000 рублей |

| 💳Платёжные инструменты | Visa/MasterCard, SMS, Moneta.ru, Webmoney, Neteller, Skrill |

| 💸Поддерживаемый язык | Русский |

| ☝Круглосуточная служба поддержки | Email, live-чат, телефон |

Регистрация Вавада казино

Чтобы оценить все преимущества Вавада, вам потребуется всего несколько минут на регистрацию. Пожалуйста, обратите внимание, что на нашем сайте приветствуются только совершеннолетние пользователи, которые регистрируются впервые. Мы придаем большое значение безопасности и поэтому строго запрещается регистрация нескольких профилей одним клиентом, так как это рассматривается как мошенничество и может привести к блокировке учетной записи.

Процесс регистрации на Вавада состоит из трех простых шагов:

- Заполнение регистрационной формы с вашими личными данными. Вам потребуется указать ваше настоящее имя, фамилию, контактный номер телефона и адрес электронной почты. Пожалуйста, убедитесь, что вы предоставляете правильные данные, так как ваш адрес электронной почты будет использоваться в качестве логина. Для подтверждения вашего возраста, мы также попросим вас указать дату вашего рождения. Обмануть систему на этом этапе невозможно, и любая попытка мошенничества может привести к постоянной блокировке вашей учетной записи.

- Открытие счета Vavada. Чтобы получить доступ к нашим бонусам и сделать ставки на реальные деньги, вам необходимо выбрать одну из предложенных валют, таких как евро, доллар, рубль, тенге, биткоин, песо, лира, гривна и другие. Выбранная валюта будет установлена как основная и не может быть изменена позже.

- Соглашение с политикой нашего казино. Подобно другим регистрациям, вам потребуется поставить галочки, соглашаясь с нашими правилами и политикой конфиденциальности. Мы рекомендуем вам ознакомиться с этими положениями, чтобы избежать случайных нарушений правил во время игры.

После нажатия на кнопку регистрации, вы мгновенно окажетесь в своем профиле. Далее нужно подтвердить адрес электронной почты. Вам будет отправлено письмо с инструкциями в вашем личном кабинете, и вам потребуется перейти по ссылке для завершения процесса подтверждения.

Верификация вашей учетной записи Vavada является необязательной. Проверка не займет больше 30 минут. Для не верифицированных клиентов установлены некоторые ограничения на вывод выигрышей. Снимать средства свыше 1000 долларов в сутки запрещено.

Регистрация и Личный кабинет ВавадаРабочее зеркало Вавада казино - Вход

Используйте рабочее зеркало Вавада казино, чтобы получить доступ к полной игротеке развлечений. В случае блокировки главного сайта, операторы поддержки оперативно предоставляют актуальные ссылки на зеркала, которые можно найти через социальные сети или обратившись к ним в онлайн-чате. Чтобы войти на зеркало Vavada, следуйте этим шагам:

- Перейдите по адресу зеркала, полученному от оператора поддержки или найденному на форумах.

- Введите свой логин и пароль в поле авторизации.

- Дождитесь загрузки профиля.

После успешного входа или регистрации вы сможете пользоваться всеми функциями и играть в полную версию казино.

Заметьте, что без авторизации на зеркале Vavada вы сможете играть только в демонстрационном режиме. Для обновления баланса в демо-режиме следует перезапустить автомат. Чтобы получить список запасных ресурсов или узнать актуальное зеркало, обратитесь к сотрудникам поддержки в чате или социальных сетях. Будьте осторожны при поиске зеркал на сторонних ресурсах, чтобы избежать мошенничества.

В случае блокировки официального сайта Vavada, когда доступ к профилю и игровому функционалу ограничен, рабочее зеркало Вавада казино является надежным способом обхода блокировок. Оно полностью повторяет оригинальный сайт в дизайне и навигации, позволяя свободно регистрироваться, пополнять счет и общаться с технической службой. Для входа на зеркало, используйте ссылку, которую можно получить у операторов в онлайн-чате, через социальные сети или на форумах.

Заранее узнавайте актуальное зеркало у службы поддержки Vavada или следите за обновлениями в социальных сетях. И помните, что официальный сайт периодически может быть заблокирован, но Вы всегда можете использовать рабочее зеркало для продолжения игры без ограничений.

Список рабочих зеркал Вавада

Ассортимент игра Вавада казино

Вавада казино предлагает большой набор игр, который удовлетворит все ваши желания. Вот некоторые категории игр, выделенные яркими неоновыми буквами:

- Слоты: Cyber Wolf, Rise of Merlin, Slotomoji, Sakura Fortune. Эти игры привлекут вас простыми правилами и классической механикой.

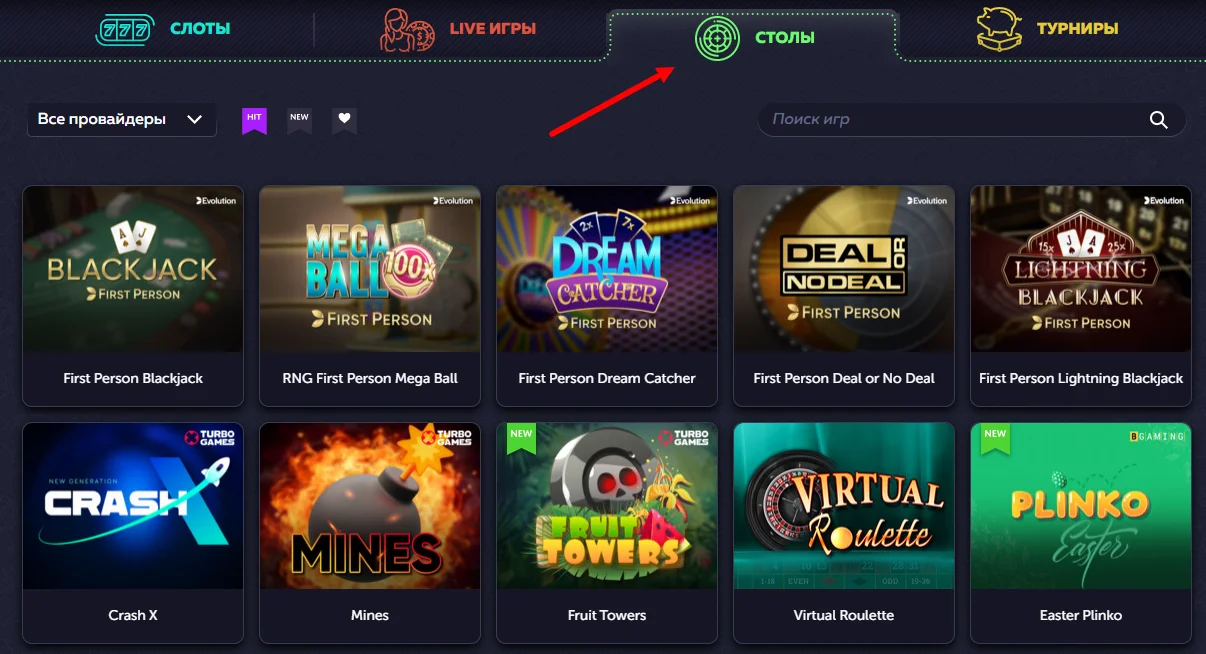

- Столы: Aviator, Fruit Towers, Space XY, Spaceman, Easter Plinko. В этой категории вы найдете разнообразные настольные игры от первого лица.

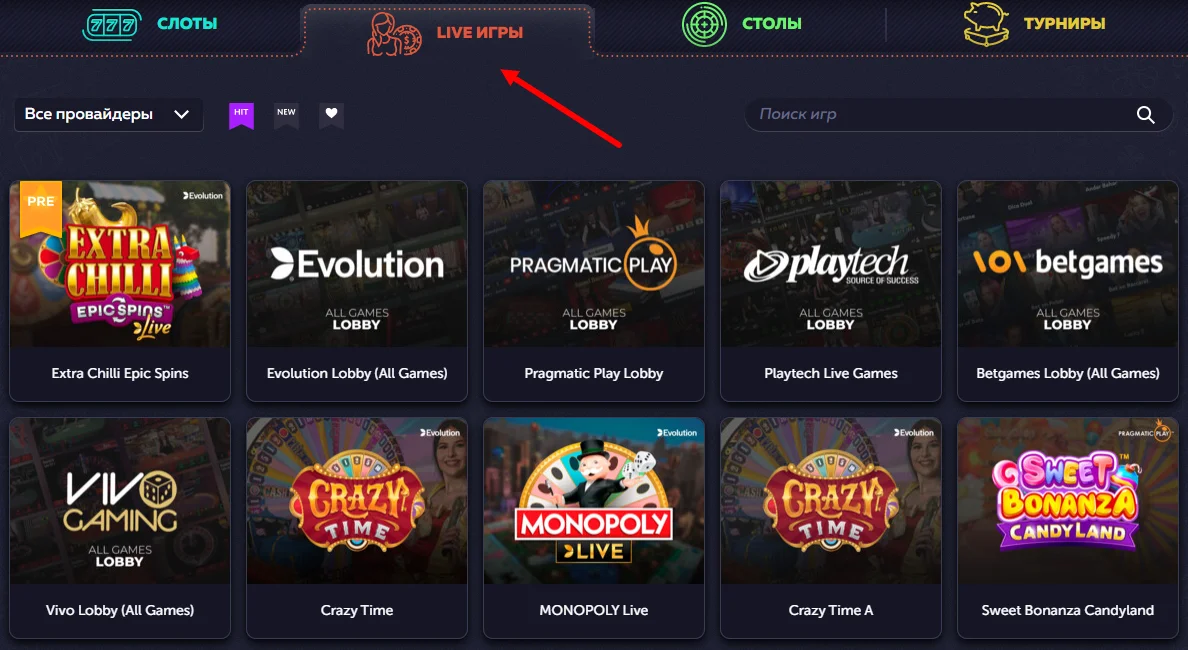

- Живые дилеры: Crazy Time, Extra Chilli Epic Spins, Dream Catcher, Crazy Coin Flip. Погрузитесь в захватывающую атмосферу с настоящими ведущими в онлайн-симуляторах.

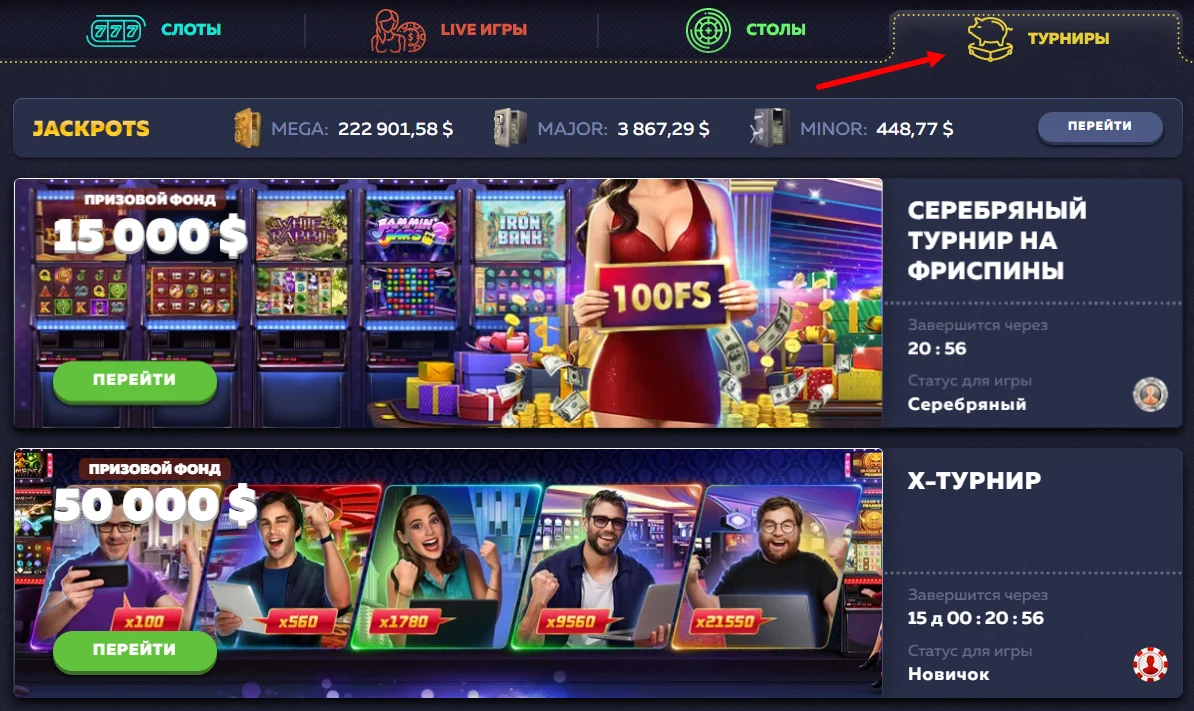

- Турниры: Вам предлагаются состязания среди новичков, золотых, серебряных и платиновых игроков за крупные призы. Присоединяйтесь к Х-турниру, турнирам на кэш и на фриспины.

Библиотека игр на Вавада казино зеркало представлена лицензированными провайдерами, которые гарантируют честность и качество своих разработок. Сотрудничество с более чем 50 компаниями, включая Betgames, Amatic, Betsoft, Blueprint Gaming, EGT, Elk Studios, Endorphina, Evolution, Tom Horn, TrueLab Games, VIVO, Yggdrasil, Igrosoft, BGaming, Big Time Gaming, Eurasian Gaming, Pocket Games Soft и другими, обеспечивает разнообразие и высокий уровень игр.

Перед началом игры рекомендуется ознакомиться с правилами, особенностями ответственной игры и требованиями казино Vavada. Помните, что азартные игры следует рассматривать как способ развлечения, а не как способ заработка.

Категория "Живые дилеры" является одной из самых популярных в казино. В лобби этого раздела на Вавада зеркало удобно размещены популярные разработчики, предлагающие следующие игры:

- Evolution Gaming: моментальные рулетки.

- Pragmatic Play: баккара и сик бо.

- Bergames: дуэли с использованием костей.

- Vivo Gaming: баккара, Teen Patti, Dragon Tiger, Blackjack в интересных тематиках.

Для начала игры в живых играх достаточно присоединиться к трансляции и сделать ставки. Вас ждет настоящий дилер, который будет вести игру через видео, объяснять правила, давать подсказки и отвечать на ваши вопросы.

Игровые автоматы Live нельзя запустить в демонстрационном режиме. Перед подключением к трансляции вы сможете увидеть превью со ведущим и оценить атмосферу студии. Чтобы полностью ощутить все эмоции от игры с живыми дилерами, потребуется сделать реальные ставки.

Турниры в Вавада организованы для участников различных уровней программы лояльности. Они предлагают оптимальную сложность в соответствии со статусом игрока и устанавливают соответствующие требования, такие как минимальный размер ставки, выбор игровых автоматов и количество призовых мест.

В Vavada казино официальный сайт вы можете играть в турниры без отыгрыша. Ограничения касаются только максимального лимита вывода средств для конкретного статуса. Новичкам разрешается выводить до 1000 долларов в день, сохраняя анонимность, а VIP-игрокам предоставляется возможность вывести 10 000 долларов и более.

На данный момент на Vavada проводятся три типа турниров:

- X-турнир: для новичков, игровая валюта - основной баланс участника, минимальный ход - 15 центов, призы распределяются среди первой сотни в рейтинговой таблице, общий фонд - 50 000 долларов.

- Турнир на фриспины: играются бесплатные вращения на выбранных популярных слотах, таких как Big Bamboo, Booty Bay, Cash Quest, Chaos Crew, Cubes 2, Deadly 5 и другие. Призы распределяются между 50 участниками. Участвовать разрешено для серебряных, золотых и платиновых игроков, а фонд составляет от 15 000 до 20 000 долларов.

- Кэш-турнир: играется виртуальными фишками на турнирных слотах, таких как Fat Drac, Fat Rabbit, Fire Hopper, Generous Jack, Mystery Mission - To The Moon. В случае неудачи можно докупить фишки не более двух раз за 6 долларов. Призовой фонд в размере 20 000 долларов распределяется между сотней счастливчиков.

Турниры проводятся также на рабочем зеркале Вавада официального сайта.

Лучшие слоты на Вавада

| 🔥 Бездепозитный бонус: | 100 фриспинов |

| 💻 Официальный сайт: | vavada.com |

| 🎲 Тип казино: | Слоты, Столы, Live, Турниры |

| 🗓 Рабочее зеркало: | Есть |

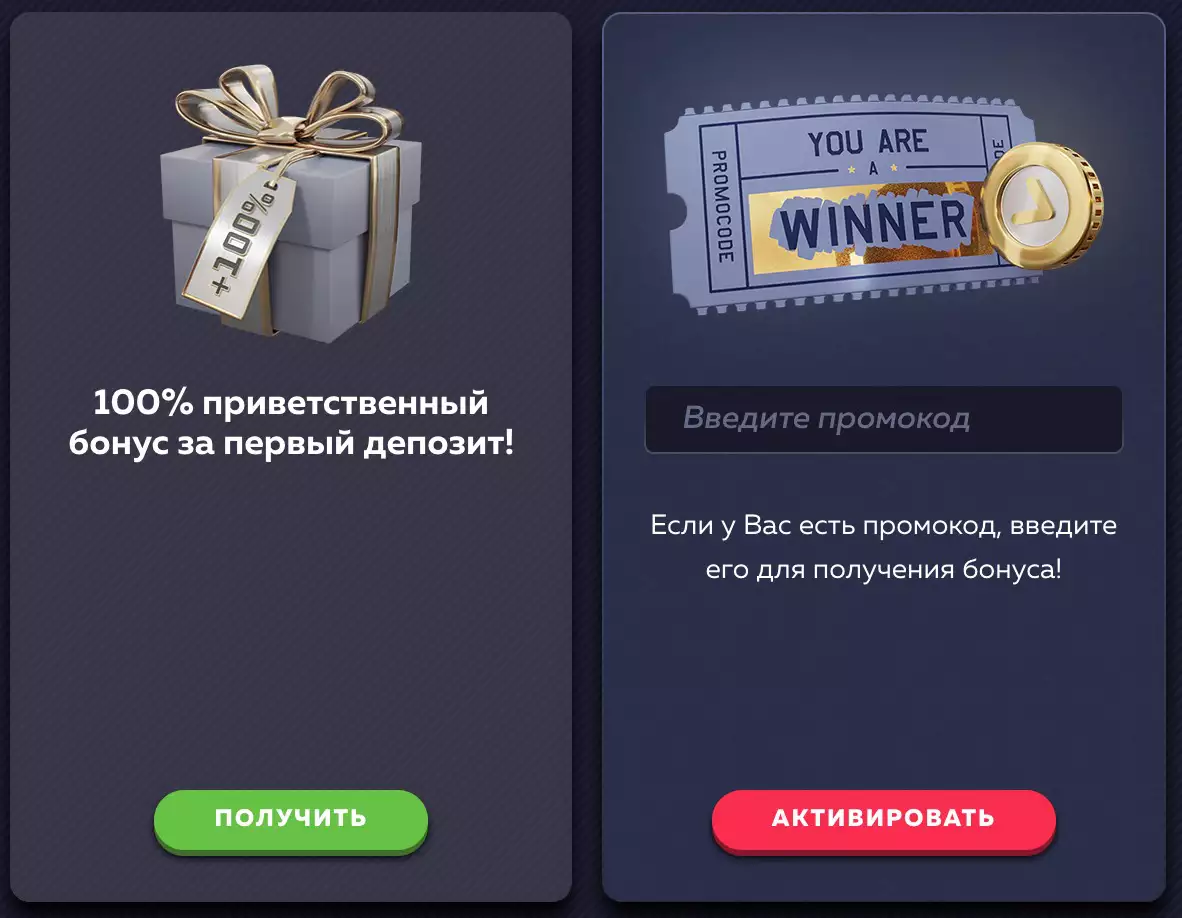

Бонусы Vavada казино

Бонусы в казино Вавада представляют собой уникальные возможности для игроков получить дополнительные преимущества и увеличить свои шансы на выигрыш. В рамках программы лояльности казино, пользователи получают различные статусы и награды. При регистрации, новичкам начисляется статус "Новичок" и предлагаются приветственные бонусы. Дальнейший рост статуса зависит от регулярного пополнения счета и размещения ставок на реальные деньги. При достижении статуса VIP, игроки получают персонального менеджера, готового оказать помощь и поддержку в любое время.

Казино Вавада предлагает три активных акции. Первая из них - это бонус в виде 100 бесплатных спинов при регистрации. Эти спины могут быть использованы в игровом автомате Great Pigsby Megaways и доступны в течение 14 дней после первого входа в аккаунт. Чтобы снять выигрыш, необходимо выполнить условия отыгрыша с коэффициентом х25.

Другой приветственный бонус включает в себя множитель депозита. При пополнении счета от 1 до 1000$ одним взносом в течение двух недель, игроки могут получить дополнительные преимущества.

Кроме того, в казино Вавада предусмотрен кэшбэк. Игроки получают возврат в размере 10% от проигрышей. Кэшбэк начисляется ежемесячно и обнуляется в начале каждого месяца. Для отыгрыша кэшбэка необходимо выполнить условия с коэффициентом х5.

В казино Vavada предусмотрены персональные промокоды. Они выдаются за активность в розыгрышах, участие в социальных сетях казино, а также за регулярные пополнения и ставки. Чтобы узнать доступность промокода, можно обратиться в службу поддержки. Оператор проверит аккаунт и сообщит о начислении вознаграждения.

Бонусы в казино Вавада являются прекрасной возможностью для игроков получить дополнительные выгоды и повысить свои шансы на выигрыш. Независимо от статуса, каждый игрок имеет возможность воспользоваться предложенными акциями и получить максимум удовольствия от игры в казино Vavada.

Служба поддержки Vavada Casino

Когда речь идет о поддержке, Vavada Casino делает все возможное, чтобы удовлетворить своих клиентов. Круглосуточная помощь доступна как зарегистрированным клиентам, так и обычным посетителям. Здесь вы не столкнетесь с ботами, ведь консультации ведут реальные специалисты, готовые помочь вам в любое время.

Взаимодействие с службой поддержки просто и удобно. Для начала диалога вам достаточно нажать на значок вопроса и описать вашу проблему. Специалист присоединится к чату в течение 5-15 минут. Они уделяют должное внимание каждому вопросу и продолжают общение, пока не убедятся, что ваша проблема полностью решена. Многие пользователи отмечают высокое качество обслуживания и оперативность поддержки в своих отзывах.

Служба поддержки Vavada Casino работает непрерывно, чтобы вы могли получить помощь в любое время суток. У вас есть несколько способов связаться с ними. На верхней панели сайта вы найдете значок вопроса, по которому можно открыть онлайн-чат. Диалоговое окно появится ниже, где вы можете использовать предложенные сообщения или написать свое.

Если вам удобнее обратиться по другим каналам связи, в блоке контактов указаны номер телефона, электронная почта и Skype службы поддержки. Вы можете позвонить по указанному номеру, уточнив предпочитаемый язык общения (русский или английский). Можете отправить запрос на электронную почту или связаться с оператором через Skype.

Вавада Casino гарантирует, что вы получите качественную помощь и ответы на ваши вопросы независимо от выбранного способа связи.

Официальный сайт Вавада казиноЧасто задаваемые вопросы о Вавада

Как играть в вавада

Вавада предоставляет простой и удобный игровой опыт. Чтобы начать играть, зарегистрируйтесь на официальном сайте, пополните баланс и выберите интересующую вас игру. Используйте бесплатный демо-режим, чтобы попробовать игры перед ставками на реальные деньги. Учтите правила и стратегии каждой игры и не забывайте о границах своего банкролла.

Vavada как снять деньги

Чтобы снять деньги с Вавада, вам необходимо зайти в свой аккаунт и перейти в раздел "Касса". Там выберите метод вывода средств, введите сумму и подтвердите операцию. Обратите внимание, что для вывода денег могут потребоваться подтверждающие документы. Убедитесь, что все условия и требования выполняются, чтобы процесс снятия денег прошел гладко и быстро.

Вавада как отыграть бонус

Для отыгрыша бонуса на Вавада необходимо выполнить условия, указанные в правилах акции или бонусной программы. Обычно требуется сделать ставки на определенную сумму или с определенным коэффициентом. Следите за прогрессом отыгрыша в личном кабинете. После выполнения условий бонусные средства станут доступными для вывода или использования в играх.

Как в вавада играть на бонус

Чтобы играть на бонусы в Вавада, необходимо активировать бонусное предложение и выполнить условия отыгрыша, указанные в правилах. Обычно требуется сделать ставки на определенную сумму или с определенным коэффициентом. После выполнения условий бонусные средства станут доступными для использования в играх и возможно их последующее снятие.

Отзывы Вавада

-

Vavada - лучшее казино, где я играл! Быстрые выплаты, огромный выбор игр и отличная поддержка. Рекомендую!

-

Никогда не думала, что на онлайн-казино можно надежно заработать. Vavada показало, что это возможно! Выигрыш пришел быстро и без проблем.

-

Играю в Vavada уже несколько месяцев. Честные игры, высокая отдача и много бонусов. Я доволен!

-

Vavada - отличное казино для любителей слотов. Впечатляющий выбор игр, привлекательные бонусы и качественная графика. Влюбилась в этот сайт!

-

Спасибо Vavada за отличное казино на мобильных устройствах! Легко играть в любимые игры в любое время и в любом месте. Рекомендую всем мобильным геймерам!